Guide To Using LHDN e-Filing To File Your Income Tax. What is the difference between Form BE and Form B.

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

Income tax return for partnership.

. Income tax return for companies. Iv The aggregation of total income can be made with one wife only. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia.

2019 B LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 COMPLETE THE FOLLOWING ITEMS Name. They will be subject to tax for any foreign-sourced income received in Malaysia effective from 1 January 2022. Your income tax refund will be done through.

Basis Period for Company. One for the husband and one for the wife. Income tax return for individual with business income income other than employment income Deadline.

This form is prescribed under section 152 of the Income Tax Act 1967 B 2016 Form Lembaga Hasil Dalam Negeri Malaysia CP4A - Pin. PUSAT PEMPROSESAN MAKLUMAT LEMBAGA HASIL DALAM NEGERI MALAYSIA MENARA HASIL. The following are contents of the Form B Guidebook.

Form C refers to income tax return for companies. Identification passport no. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. 30042022 15052022 for e-filing 5. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

A complete guide on how to fill out the Form B. Tax Offences And Penalties In Malaysia. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing.

For residents earning income. This form can be downloaded and submitted to. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN.

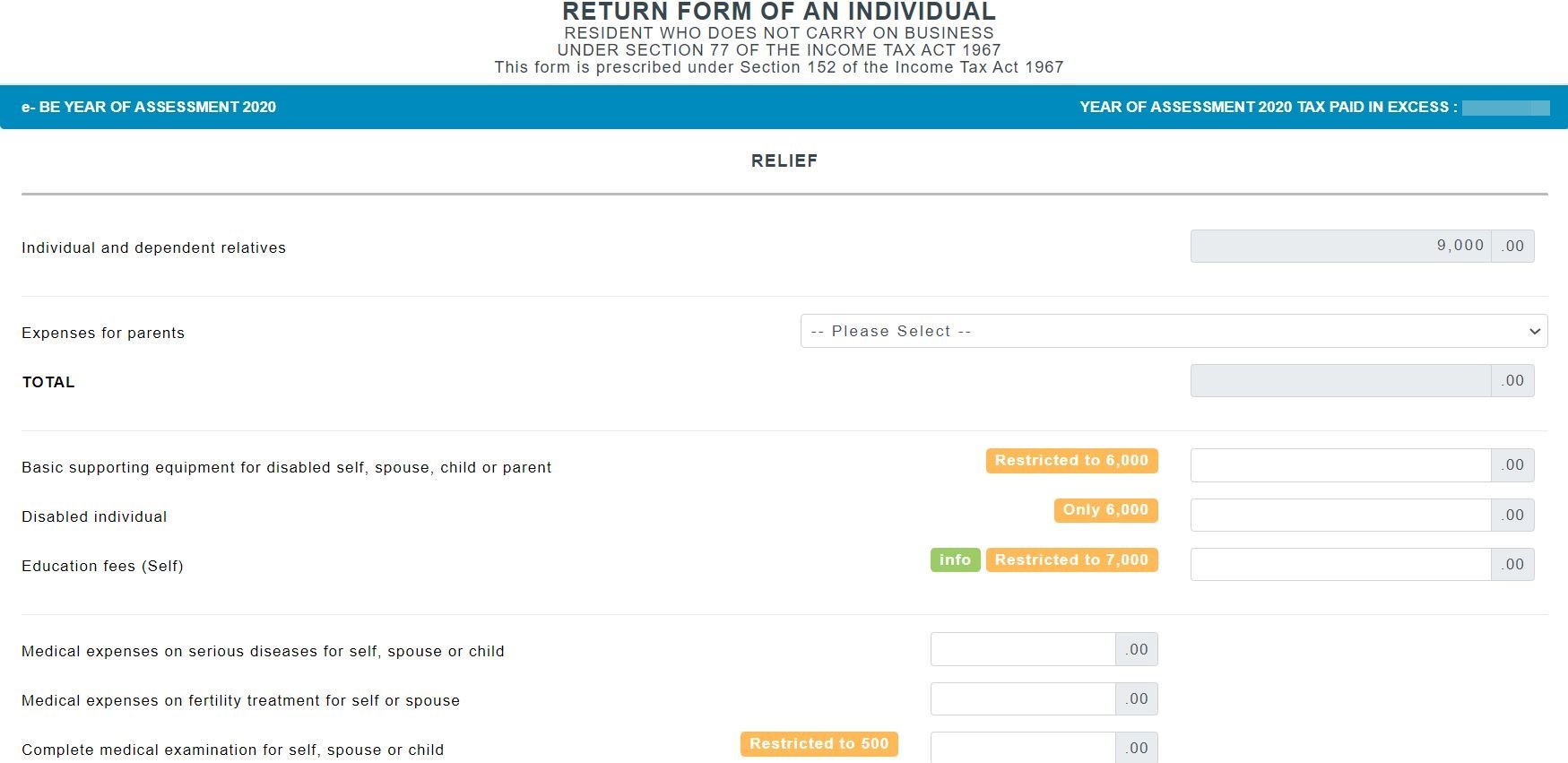

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Simplified forms with explanations and guides on how to fill out those forms and compute the chargeable income and income tax have been prepared to assist taxpayers. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

2 Married individuals who elect for separate assessment are required to fill out separate tax forms BBE ie. You will be charged a penalty under subsection 1123 of the ITA 1967. Assessed in the name of the spouse both are still reguired to fill out separate tax forms BBEThe husband.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused. Tax File Registration. Calculations RM Rate TaxRM A.

How To File Your Taxes Manually In Malaysia. YEAR OF ASSESSMENTForm Amend. Lembaga Hasil Dalam Negeri Malaysia Special Industry Branch Tingkat 11-13 Blok 8 Kompleks Bangunan Kerajaan Jalan Tuanku Abdul Halim 50600 Kuala Lumpur.

Form B Guidebook Self Assessment System 3 Reminder Before Filling Out The Form Please take note of the following. COMPUTATION OF INCOME TAX B1 Statutory income from employment. MyTax - Gerbang Informasi Percukaian.

Electronic Fund Transfer EFT to your bank account. Inland Revenue Board of Malaysia IRBM will issue a notice of assessment under subsection 903 of the ITA 1967 and the taxpayer is required to pay additional taxes and the original tax if still unpaid within 30 days from the date the notice is. Go back to the previous page and click on Next.

Amending the Income Tax Return Form. How To Pay Your Income Tax In Malaysia. Income tax return for individual who only received employment income.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form C. Download a copy of the form and fill in your details. Form BE Form B TOTAL INCOME - SELF Form BE Form B Form BE Form B or or or C34 C35 C36 C16 C17 C18.

Form B - income assessed under Section 4 a - 4 f of the ITA 1967 and. July 31 the due date for filing income tax return ITR for assessment year. If you need further step-by-step guidance on how to fill in your income tax form do also check out our income tax guide for 2022 YA2021 here.

Will penalty be imposed if I submit the Form B after 30th June. Verify your Form 26AS and Annual Information Statement first. BE Form - income assessed under Section 4 b - 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business.

2016 1 YEAR OF ASSESSMENT. Please read this with care so that the return form and declarations made therein for Year of Assessment 2020 are true complete and correct. 30062022 15072022 for e-filing 6.

Change In Accounting Period. Click on Permohonan or Application depending on your chosen language. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing.

What is Form B Guidebook. Agreement with Malaysia and Claim for Section 133 Tax Relief HK-10 InstalmentsSchedular Tax Deductions Paid 31. Provision of section 7 of Income Tax Act 1967 ITA 1967 or deemed to be resident under subsection 71B of the same Act in completing the Form B for Year of Assessment 2020.

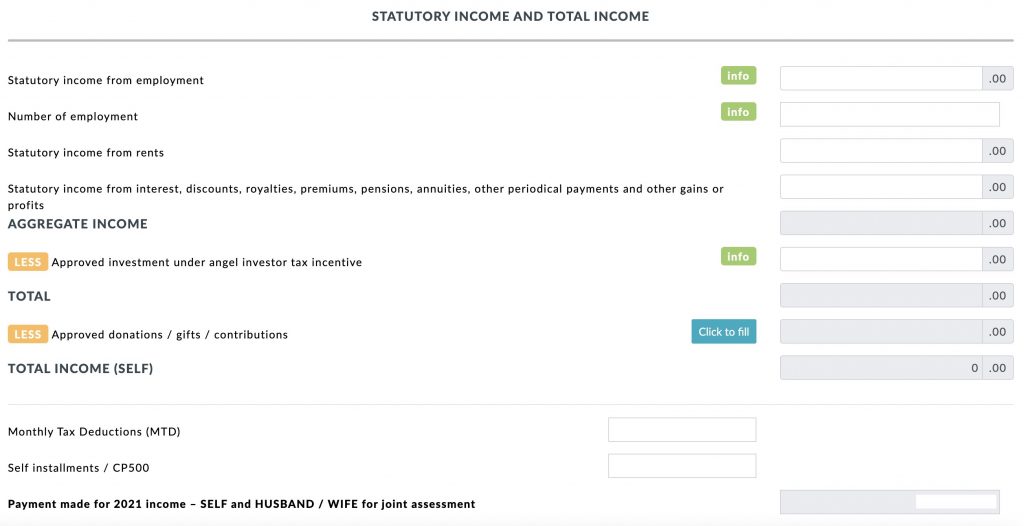

Click on e-Filing PIN Number Application on the left and then click on Form CP55D. In this form you will be able to declare your side income under Statutory income from interest discounts royalties pensions annuities other periodical payments and other gains and profits. Income tax return form ITRF Category.

Iii The husband wife who elects for joint assessment must be a Malaysian citizen if not resident in Malaysia. Ii Has total income to be aggregated with the total income of the spouse. A series of Working Sheets series HK-1.

On the First 5000 Next 15000. 1 An individual who carries on a business is required to fill out the Form B. On the First 5000.

WP0218 If Undelivered Return To. The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. To clarify other gains and profits is defined as payments received for part-time or any broadcasting lecturing writing and other.

Form CP251 NEW FORMS CP250 CP 251 WILL TAKE EFFECT FROM JUNE 2018. Best Fixed Deposit Accounts In Malaysia July 2022.

Terms Of Agreement Sample Inspirational 22 Examples Of Employment Contract Templates Word Contract Template Contract Agreement Employment

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2021 Ya 2020

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Business Income Tax Malaysia Deadlines For 2021

Malaysia Personal Income Tax Guide 2022 Ya 2021

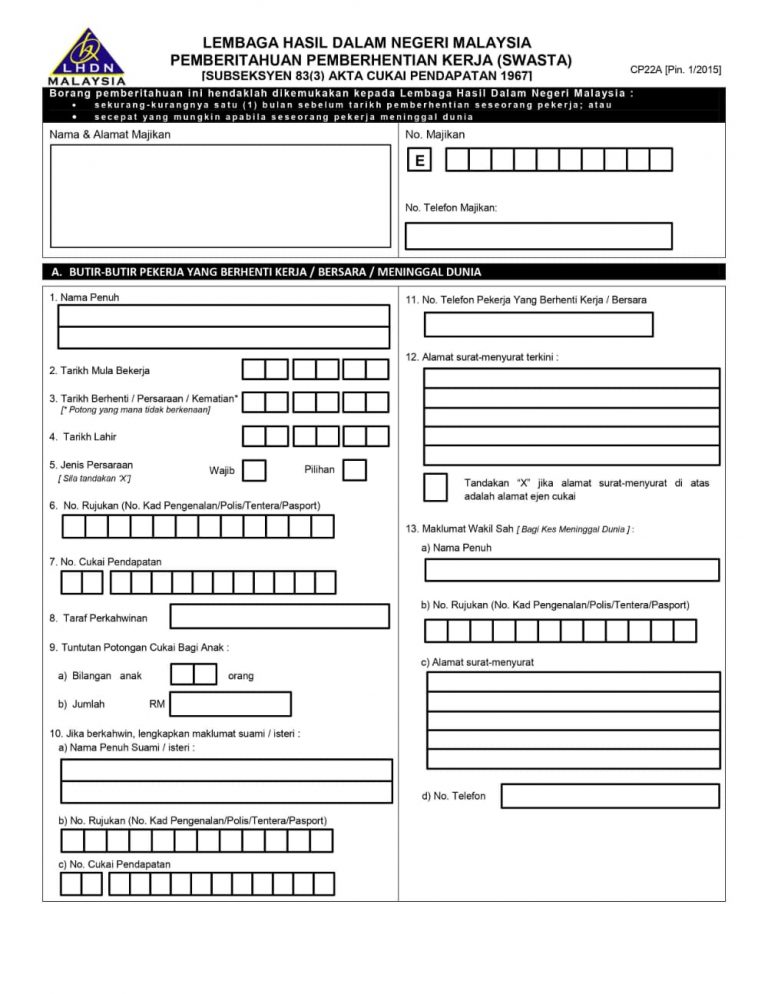

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Is Aadhaar Card Mandatory For Nri Cards Finance City Office

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Guide To Using Lhdn E Filing To File Your Income Tax

Mileage Reimbursement Form Template Awesome 47 Free Claim Forms Mileage Reimbursement Elementary Lesson Plan Template Lesson Plan Templates

How To File Your Taxes If You Changed Or Lost Your Job Last Year

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll